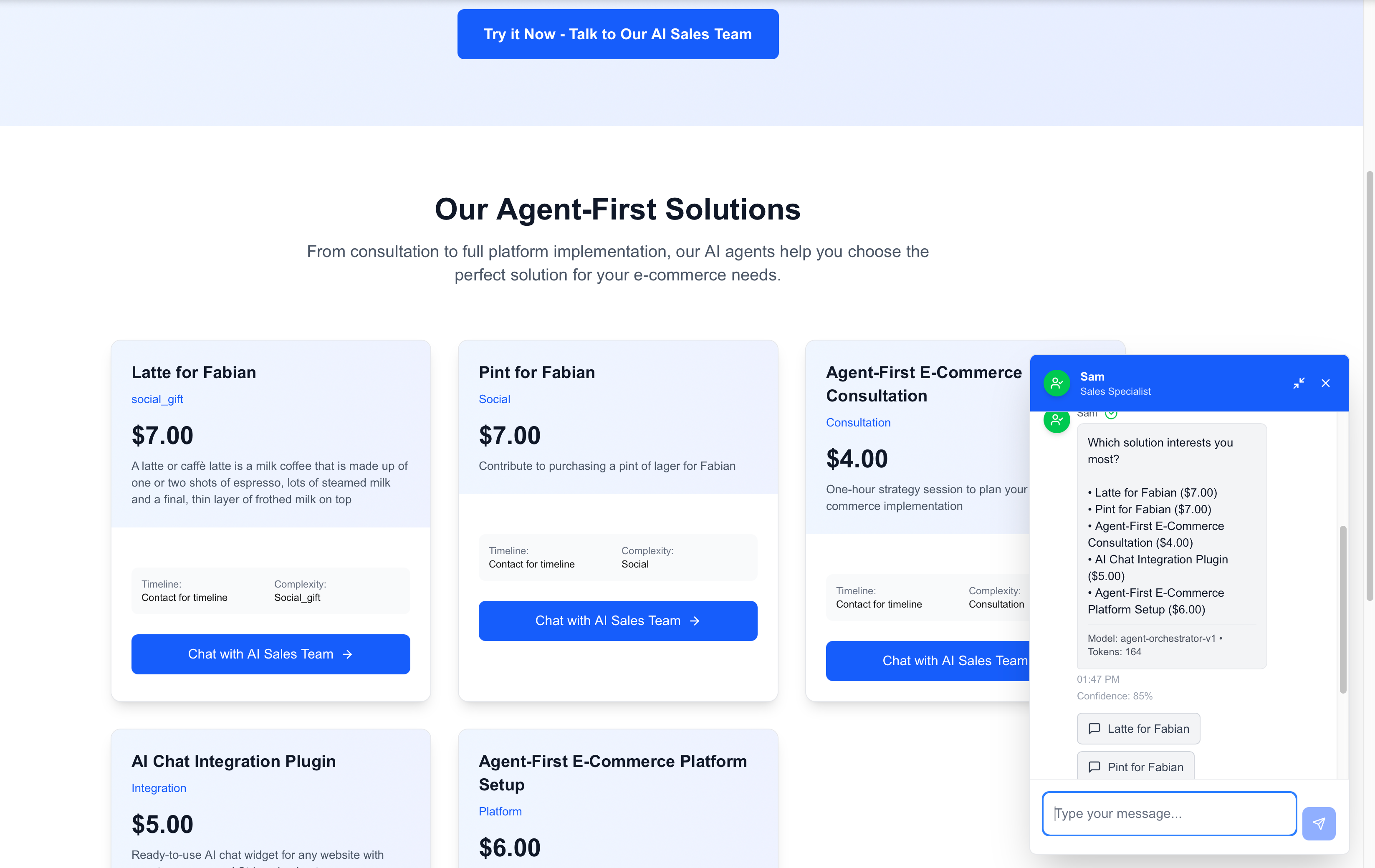

Student Loan Debt Forgiveness Survey Results - 1 Week

Sentiment Analysis Charts and Graphs from the Survey Respondents after 1 Week

TLDR;

Checking in on the results after 1 week in the wild of publishing this survey https://www.thatsgreatfeedback.com/studentloandebtforgive to capture feedback on the news that President Biden is considering Student Loan Debt Forgiveness and the results after 1 week are tabulated again.

Huge Thanks to all the folks out there who took the time to fill out the brief 9 question Anonymous survey that yielded the below results! We were only able to get (as of the time of this post) 55 folks to respond 😊 to the survey. Notwithstanding, we have compiled the results for you below.

The Past 1 Week

There are 5 questions posed and in one free from around the subject matter and 4 demographic questions. The free from response question centered around folks reaction to the the easing/forgiving of Student Loans. The responses throughout the week remained consistent with sentiments were overall positive with overwhelmingly positive polarized feelings towards the Student Loan Debt Forgiveness by the Joe Biden administration. What we did see however is that most responders to the survey agreed that student loans are expensive, some even said Predatory and is too high, here are a few examples that contributed to our word cloud and sentiment analysis:

Positive Affirmation to President Biden Announcements

1) The cost of education in the United States is criminal. Citizens in developed nations have had the right to free higher education since 1966. Our nation is a disgrace to the word freedom

2) Too high, should be free/low cost

3) Costs are way too high and make it inaccessible for people to get an education

4) Way to high, predatory.

5) Tuition is high; however, the lender's interest surpasses Tuition costs as it's compounded. This makes interest almost 100% of Tuition. Politicians have not confronted this.

Also, women are taking a huge brunt of this scam. We are paid lower than men and have often attempted to increase our wages with going to college only to face another issue: ageism in America at 40. I was let go in my 40s and earn much less. I earned 38k to 55k per year until At 44, $55k per year then let go, at 45 $33k per year, at 46, 28k (which I was forced to cash out 401k, at 47 22k per year.

Negative feedback to President Biden Announcements

9) It’s abhorrent. A system full of graft and inflated costs in the name of profit. Administrators at my school (administrator of intramural sports and student events for instance) made more than $300,000/yr. and there were dozens of them. Absolutely ridiculous. However, any solution to student debt should be forward looking, preventing future generations from being financially taken advantage of by this system. It’s tough, but the people that have already taken out loans should have to repay them. The government doesn’t have the money to pay private student loan debt, and doesn’t have the right to do so either. Cancellation of federal student loan debt will disproportionately impact those who were unable to get access to Federal Student Loans, leaving them well behind their peers financially. Again, it’s a tough decision but any solution and financial resources allocated toward the problem should be forward facing. Money isn’t infinite and the federal government needs to stop treating it like it is.

10) It is complicated. Most people with massive debt were mostly failed by their parents and guidance counselors that should have stopped them from making such a colossal mistake. Also the govt guaranteeing student loan debt allows these people to get loans, no sane lender should even agree to loan someone 200,000 for an at

ry history degree. However ultimately, it wasn’t a secret what degrees were worthless, yet people still chose to go into debt to get them. Everybody shares some amount of blame

11) It is outrageous, and student loans are worse. Most people I know have paid all or almost all the original amount they borrowed but owe more than when they started. I borrowed $20k and after making payments faithfully for years, I owed $25k. It's immoral and doesn't when make sense.

12) It’s ridiculously expensive, we need to fix this first before we even discuss forgiveness for loans already out there. Also, I could support 10,000 given to *all* households who filed tax returns as another stimulus check. Then people who have student loans could use it for those, while also not leaving out people who chose not to attend school.

13) Policy should modify future loans to tackle education costs. Existing loans should be left as is, borrowers signed and agreed to pay back money and should be held liable to do so.

A world cloud below homed in on

- Expensive

- Loans

- High

- Free

- Education

Question Posed: 9. Your thoughts on the Cost of Education in America? :

| Fig.1 - Word Cloud showing Intensity to #9 Question posed|

Subjectivity and Polarity

When it comes to Subjectivity in this context of this research, it quantifies the amount of personal opinion and factual information contained in the response to an open ended question like question number nine (9), whilst Polarity defines the orientation of the response measuring how positive, negative, or neutral the consideration to the question being posed and its response. After 1 week, by and large the sentiment and polarity kept the trend and expanded, there were polarity on both ends but more positive but negative.

Question Posed: 9. Your thoughts on the Cost of Education in America?:

| Fig.3a - Scatter Plot showing Subjectivity & Polarity in response to #9 Question posed|

We saw 56.4% positive sentiments with 30.9% negative responses based on our NLP model. Overall sentiments are also shown in the below histogram.

| Fig.3b - Histogram showing response to #9 Question posed|

Corollaries

While the responses largely remained the same over the course of 1 week, and only strengthen, there’s a few things I’d call out:

- While by a measure of almost 2:1 responders responded positive to the statements of President Biden on Student Loan Debt Forgiveness, when asked about the “Treatment of Student Loans”, next to “forgiveness”, others said “Leave it as it is”! with the only other response being to “Reduce it” by 1⁄3 of the Forgiveness sentiment.

- By a factor of 2:1 responders cited NOT having a Student Loan, now you may say …wait a minute but if you look at the data, you will find that most responders cited Paid in Full for their impact, meaning that they paid off their student loans

- We also saw that most survey responses came form individuals between the ages of 26 to 34 and most are Post Graduate or In University, however by a factor of 3:1, responders to the survey are Employed.

For a breakdown of those conclusions, here is the raw data below:

Question Posed: 1.How do you feel about President Joe Biden consideration on Student Loan Debt Forgiveness?

| Fig.4 - Responders feeling towards ruling of mask mandate lifted|

relative to the responses of 3.On Student Loan Debt Forgiveness. Do you think it should be? below you can see

| Fig.5 - How to handle Student Loan Debt|

that folk vastly favor Student Loan Forgiveness at about ~ 3:1 when compared to Reducing it OR Leaving it As Is!

Who Took our Poll?

Our poll is anonymous but we asked the respondents to identify by impact their relationship to the topic, the feedback we got indicated:

Question 4. What is our relationship with Student Loans? ?

| Fig.6 - How do people taking the survey identify|

put another way, here are the exact numbers for people taking the survey

| Fig.6b - How do people taking the survey identify|

Demographics

5. What is your age range?

| Fig.7 - Age Range|

6. Highest level of education?

| Fig.8 -Education Level|

7. Which of the following best describes you?

| Fig.9 - Race/Ethnicity|

8. Employment status?

| Fig.10 - Employment Status|

Finally, If you have not yet… Please consider taking the Survey here https://www.thatsgreatfeedback.com/studentloandebtforgivel

Continue the conversation

| Engage with me | Click |

|---|---|

| - Tweet | |

Or use the share buttons at the top of the page! Thanks

Cheers! Fabs